December 10, 2019:

Here’s How to Pay off Your Mortgage Faster

Did you know that the average Canadian spends 40 hours a week working hard to ensure they have the money to pay their loans, monthly bills, save for home renovations, family vacations, or even to prepare for their future?

For many, all of these expenses have a monthly mortgage payment hovering on top. While you may be tempted to opt for a longer mortgage period in order to pay a smaller monthly amount, it will end up costing you more in the long run.

Here are some useful tips that will help you pay your mortgage off faster and save you interest costs in the long-run.

Amortization Period:

An amortization period is the amount of time it takes to pay off your mortgage. The average amortization period is typically around 25 years with the maximum period being 35 years.

Choosing a Shorter Amortization Period:

A shorter amortization period means you will be paying higher monthly payments, but it also means that you will pay significantly less interest over the life of your full mortgage. You can choose a shorter period when you set up your mortgage or when your mortgage term is up for renewal.

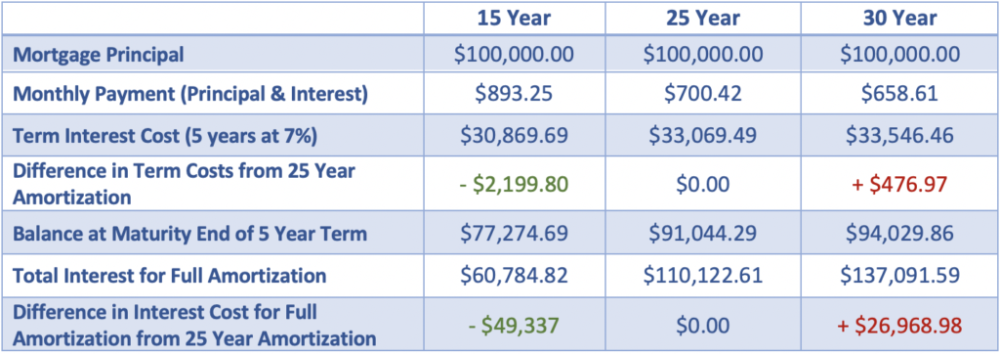

The chart below shows the comparison of the same $100,000 mortgage and the significant difference of total interest with the mortgage principal being stretched over 15 years, 25 years, and 30 years.

Choosing a Longer Amortization Period:

To qualify for a longer amortization, you must make a down payment of at least 20% of the purchase price of the property. The maximum amortization for most lenders is 30 years (up to 35 years with a few lenders). If you choose a longer amortization, you may wish to consider a strategy to reduce the time it will take to pay off your mortgage over the life of your mortgage, as your cash flow allows. Banks and lenders offer a variety of interest-saving options, such as doubling up payments, accelerated payments, annual payment increases by up to 20%, and lump-sum payments up to 20% annually of the original mortgage amount (with some lenders allowing these payments on any payment date). Taking advantage of one or several of these prepayment privileges can get you on track to an even shorter amortization period.

It is always best to talk to your mortgage specialist to see if these options work for you and what other options you may have based on your specific mortgage.

Payment Frequency

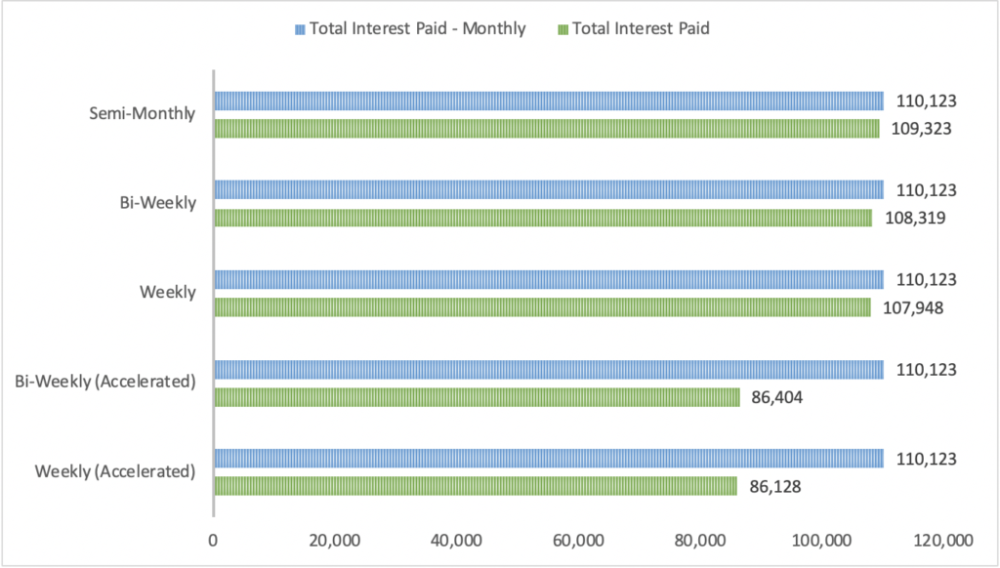

More frequent payments are one of the ways you can pay off a mortgage sooner. You have the choice of weekly, biweekly, semi-monthly or monthly payments. Weekly and biweekly payments can be accelerated, which means that you make a slightly larger payment each time, which amounts to the equivalent of one extra monthly payment a year.

The chart below shows the comparison of the same $100,000 mortgage and the difference in total interest based on the payment frequency.

Double-Up Payments

With a Double-Up payment, your payment goes directly toward reducing the principal balance of your mortgage. You can:

Prepay up to the principal and interest portion of your mortgage payment on any or every payment date

Pay up to the equivalent of your regular monthly mortgage payment, whether it’s weekly, biweekly or monthly

The following example of a $100,000 mortgage at 7% shows how you can dramatically reduce the time it takes to pay off your mortgage simply by doubling up one monthly payment each year.

For example, say you are making monthly payments on a $100,000 mortgage that has a 25 year amortization period. If you were to double up on one of those monthly payments per year, not only would you save $21,469 in interest costs, you would also shorten the amortization period to 20.8 years!

Principal Prepayments

Applying principal prepayments directly to your mortgage principal allows you to:

Prepay up to 20% of the original amount of your mortgage any payment date

Make a principal prepayment at renewal time for any amount you wish

A principal prepayment of even $2,000 a year can make a sizeable difference in the time it takes to pay off your mortgage.

For example, say you have a $100,000 mortgage that has a 25 year amortization period. If you were to make an annual $2,000 prepayment, not only would you save $43,760 in interest costs, you would also shorten the amortization period to 16 years!

Increase Your Payment Amount

Any payment date, you are able to increase the amount of the principal and interest portion of your mortgage payment by as much as 2o% without any prepayment charge. The increased amount goes directly towards your principal.

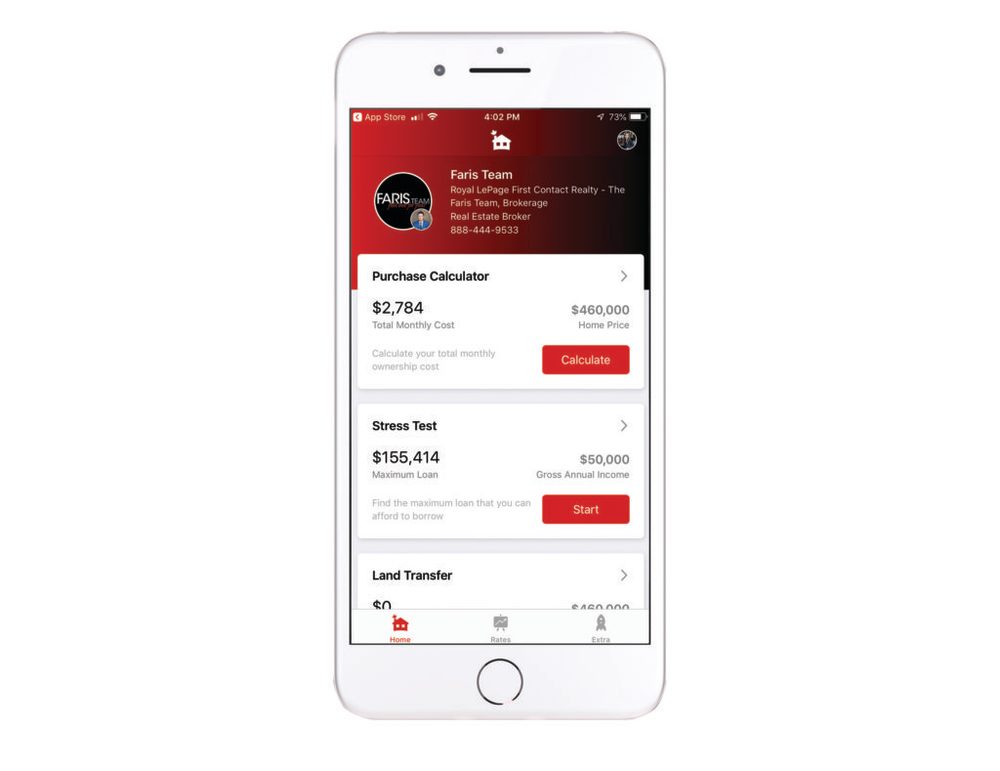

If you’re looking for an app to save you time and frustration, go straight to the top: Faris Team’s Canadian Mortgage App provides a wide array of tools and tips to help you calculate expected costs, loan borrowing fees, and so much more.

Click here to download the app

For complete information on our Faris Team Canadian Mortgage App, click here.

Not all mortgages are created equal so the best way to figure out which mortgage is best for you is to allow a mortgage broker to assist you in choosing the right mortgage from the right lender for your specific circumstance.

Have Questions?

Call our in-house mortgage expert, Tim Walker at

Call us today at 1.888.918.6570, send us an email or book an appointment.

There’s absolutely NO OBLIGATION. Consultations with our team of experts are FREE.